To improve your accounting skills, engage in continuous learning and practice regularly. Obtain certifications like CPA or CMA to enhance your professional knowledge.

Accounting skills are essential for finance professionals and those aspiring to excel in the industry. Mastery of these skills can lead to better job performance, career advancement, and a deeper understanding of financial operations. Strengthening your accounting abilities involves a mix of formal education, hands-on experience, use of current software, and staying updated on industry trends.

Professional development courses, workshops, and webinars serve as platforms for learning new accounting techniques and regulations. Adopting these practices not only sharpens your skillset but also signals commitment to your role, potentially opening doors to new opportunities. Ensuring your accounting knowledge remains current is not just about keeping up with changes; it's about being prepared to tackle complex financial challenges with confidence.

The Role Of Accounting Skills In Career Success

Accounting skills are a ladder to career success. These are like invisible tools that help professionals climb higher. They allow for better decision making. Talents in accounting open doors to various sectors. From finance to management, a strong grasp on numbers is key.

Importance Of Precision And Detail

Being precise and detail-oriented is non-negotiable in accounting. Errors in calculations can lead to big problems. This is true for both small businesses and large corporations:

- Meticulous work safeguards against financial mistakes.

- It ensures companies stay compliant with regulations.

- Attention to detail builds trust with clients.

Correct entries are the foundation of solid financial reports. They ensure accurate analysis and forecasting. Precise accounting skills set a professional apart.

Advantages Of Strong Accounting Skills In The Workplace

- Better Budgeting: Clear understanding of the numbers leads to effective budget management.

- Financial Reporting: Skilled accountants produce reliable reports. These help in strategic planning.

- Regulatory Knowledge: Professionals keep pace with changing laws. This secures the company's legal standing.

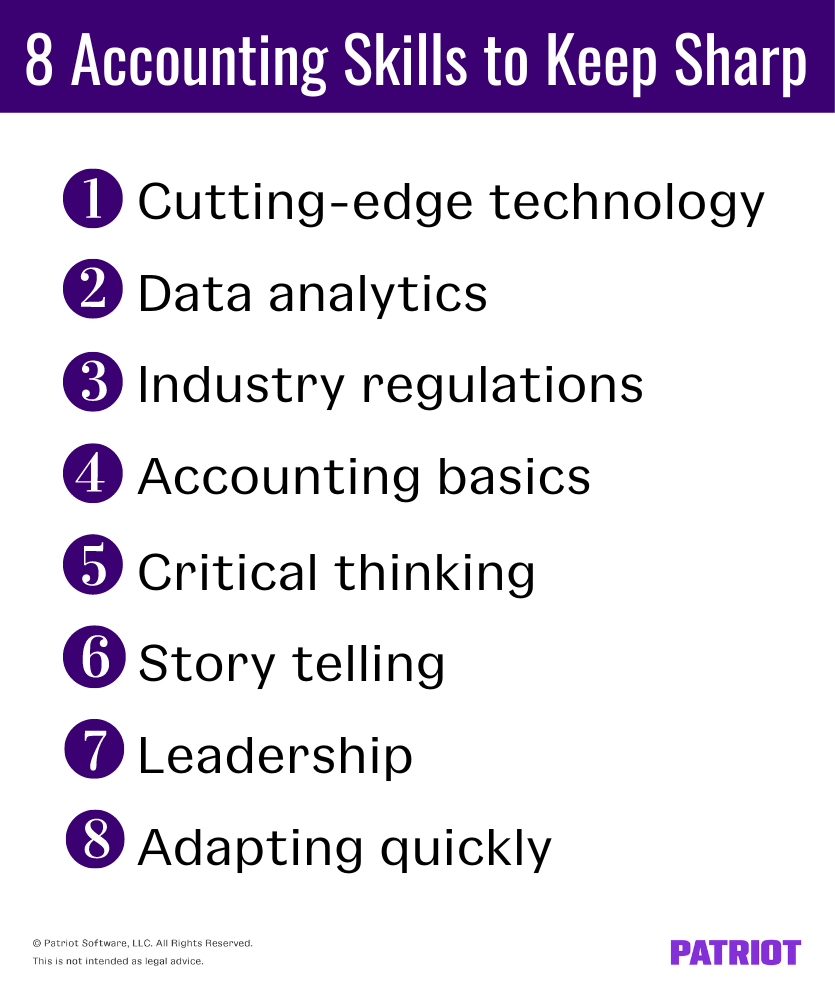

Success in accounting means mastering various skills. These include data analysis, communication, and the use of software. Individuals with solid accounting abilities are valued. They can navigate complex financial landscapes.

Assessing Your Current Accounting Proficiency

Assessing Your Current Accounting Proficiency is the first critical step in improving your accounting skills. Before embarking on any learning journey, it’s essential to know where you stand. Understanding your current level of expertise allows you to customize a learning path that targets areas most in need of improvement.

Self-audit Of Your Accounting Knowledge

Conducting a Self-Audit of Your Accounting Knowledge involves a systematic review of your skills. Start by listing the different areas of accounting that are most relevant to your work or goals. Rate your comfort and proficiency in each area to get a clear picture of your skills landscape.

Add more rows as required| Accounting Area | Proficiency Level |

|---|---|

| Bookkeeping | Rate here |

| Financial Reporting | Rate here |

| Tax Preparation | Rate here |

Identifying Weaknesses And Building A Plan

Identifying Weaknesses is pivotal to growth. Examine the areas where you scored lower in your self-audit. Recognize patterns or specific topics that repeatedly cause trouble. Garner resources like books, courses, or workshops that focus on these weaknesses.

- Inventory Management: Aim for resources that simplify concepts.

- Software Proficiency: Practice with real-world accounting software.

- Regulatory Knowledge: Stay updated with the latest tax laws.

Building a plan with set goals and deadlines transforms weaknesses into strengths. An organized approach ensures that you allocate time for each aspect of your learning.

- Set specific learning goals.

- Create a timeline for achieving these goals.

- Monitor progress regularly.

Fundamental Accounting Principles To Master

To become an expert in accounting, mastering fundamental principles is crucial. These principles form the bedrock of reliable financial reporting and analysis. By understanding and applying these basics, accountants can ensure accuracy and consistency in their work. Let's dive into some of the essential building blocks of accounting knowledge.

Embracing The Basics Of Debits And Credits

Every transaction in accounting involves debits and credits. These two elements must always balance, reflecting the double-entry system of accounting. Here is a simplified guide to get you started:

- Debits usually increase asset or expense accounts.

- Credits usually increase liability, revenue, or equity accounts.

To practice, consider creating simple ledger entries. This will solidify your understanding of how debits and credits work in various transactions.

Understanding Financial Statements

Financial statements tell the story of a business's financial health. The three main statements you should focus on are:

- The Balance Sheet: It shows a company’s assets, liabilities, and equity at a specific point in time.

- The Income Statement: It summarizes revenue and expenses over a period, showing profit or loss.

- The Cash Flow Statement: It details the cash entering and leaving a business.

Start by reviewing these documents for different companies. This will help you recognize patterns and understand the financial impact of various business activities.

Leveraging Technology To Enhance Accounting Skills

In the dynamic world of accounting, mastering the latest technology is key. Tech tools not only streamline complex tasks but also open doors to new learning opportunities. Accountants eager to upgrade their skills can ride the digital wave to a more efficient future.

Accounting Software To Boost Efficiency

Accounting software transforms how professionals work. It eliminates manual calculations, minimizes errors, and saves time. Here are top picks to consider:

- QuickBooks: Ideal for small businesses

- Wave: Offers free basic services

- Xero: Great for collaboration

- FreshBooks: User-friendly for invoicing

Interactive tutorials for these tools sharpen your skills. Use trial versions to practice real-world tasks.

The Impact Of Automation On Accounting Practices

Automation is revolutionizing accounting. Look at the changes:

| Before Automation | After Automation |

|---|---|

| Manual data entry | Data flows automatically |

| Error-prone processes | High accuracy in records |

| Time-consuming tasks | Quick report generation |

Embrace automation to stay ahead. Online courses on automation software boost your expertise. Practicing on cloud-based accounting platforms familiarizes you with up-to-date practices.

Enrollment In Professional Accounting Courses

Enrollment in Professional Accounting Courses is a crucial step for anyone aiming to enhance their accounting skills. Not only do these courses offer structured learning, but they also provide updated knowledge in line with the latest industry standards. With a focus on practical skills and comprehensive knowledge, these courses can pave the way to mastering accounting principles and techniques.

Choosing The Right Course For Your Needs

Selecting a suitable accounting course involves understanding personal career goals and learning preferences. Here are key points to consider:

- Determine goals: Define what you wish to achieve with the course.

- Course content: Ensure the course covers essential accounting concepts.

- Reputation: Look into the course provider’s industry standing.

- Flexibility: Consider the course schedule and delivery method.

- Reviews: Read feedback from past students for insights.

Continued Education For Ongoing Improvement

Consistent learning is key to staying updated in the dynamic field of accounting. Here's why continual education matters:

- Knowledge refresh: Regular courses keep your knowledge current.

- New skills: Learn new tools and technologies as they emerge.

- Career advancement: Higher qualifications often lead to better job prospects.

- Professional network: Courses connect you with peers and mentors.

- Certification: Gaining additional certifications can validate your expertise.

Gaining Practical Experience Through Internships

Embarking on an internship is a crucial step for anyone aspiring to excel in accounting. This practical experience bridges the gap between theoretical knowledge and real-world application. Internships offer a glimpse into the daily workings of the finance world, sharpening skills and providing a competitive edge.

Learning From Real-world Accounting Scenarios

When you're knee-deep in numbers, the experience can be the best teacher. Internships bring academic concepts to life. They aid in understanding complex financial systems within a company. Interns tackle tasks like bookkeeping, auditing, and preparing financial statements, which are vital to any business.

- Develop hands-on skills with accounting software

- Analyze real financial data

- Understand the end-to-end accounting cycle

Networking And Mentorship In Accounting

Internships open doors to valuable connections. Mentors can guide you through complex accounting challenges. They share insights that could take years to learn independently. Networking introduces you to potential employers and colleagues. It creates a foundation for a strong professional network.

| Benefits | Examples |

|---|---|

| Guidance | Personalized feedback on your performance |

| Insider Knowledge | Learn industry-specific best practices |

| Professional Growth | Building a network for future opportunities |

The Power Of Networking In Accounting

The Power of Networking in Accounting proves invaluable for professionals looking to enhance their skill set. Effective networking opens doors to knowledge-sharing, mentorship opportunities, and collaborative learning. By forging connections with experts, accountants gain insights into industry trends, complex problem-solving techniques, and advance their careers through valuable exchanges. Let's dive into strategies for building your network and fortify your accounting prowess.

Connecting With Industry Professionals

Building relationships with seasoned accountants is a game-changer for skill enhancement. Consider these action steps:

- Attend industry conferences and workshops.

- Engage in LinkedIn discussions with accounting leaders.

- Seek mentorship or shadowing opportunities.

Use professional gatherings to exchange contacts. Always follow up with new acquaintances. This ensures you remain fresh in their minds.

Joining Accounting Groups And Forums

Venturing into the digital expanse widens one’s professional circle. Below are platforms to consider:

| Platform | Benefits | How to Engage |

|---|---|---|

| Online Forums | Peer support, problem-solving, news | Post questions, share knowledge, offer solutions |

| Social Media Groups | Updates, job postings, advice | Comment on posts, network, stay active |

| Webinars | Training, expert insights | Participate, ask questions, apply learnings |

Accounting forums and groups are excellent for staying abreast of best practices. Regular interaction online reinforces knowledge and skills.

Improving Analytical Skills For Better Decision Making

Good decision making is crucial in accounting. To make the best decisions, you need strong analytical skills. These skills help you understand complex information. This understanding leads to better financial choices. The road to enhancing your analytical abilities begins now.

Critical Thinking In Financial Analysis

Accountants face lots of numbers and data every day. Thinking critically about this information is key. It's not just about seeing numbers. It's about asking the right questions. Why does this number look this way? What does this trend show us? To cultivate this skill:

- Question every figure, even if it seems correct.

- Consider all possible scenarios.

- Identify patterns and exceptions in financial data.

- Use simulations and what-if analyses.

Interpreting Data For Strategic Planning

Strategic planning guides a company's future. Data tells us a story about where a company stands. Interpreting this data helps chart out a path forward. You need to:

- Understand the context behind numbers.

- Translate data into actionable insights.

- Employ tools like SWOT analysis to guide decisions.

By combining data interpretation with strategy, you position yourself as a valuable asset in any accounting team. Ready to enhance your skillset?

Adopting A Problem-solving Mindset In Accounting

Welcome to the transformational world of accounting—a field that demands meticulous attention to detail and a swift problem-solving approach. Enhancing your accounting skills often hinges upon the capacity to tackle complex financial issues head-on. To thrive as an accountant, it becomes critical to cultivate a mindset that not only identifies problems but also devises effective solutions. Below, we delve into the heart of adopting a problem-solving mindset in accounting.

Addressing Common Accounting Challenges

Accountants face myriad challenges that can strain even the most astute financial minds. From reconciling bank statements to managing cash flow, these tasks require precision and a proactive attitude. But how can you effectively conquer these common hurdles? Start with these strategies:

- Understand Accounting Principles: Solid familiarity with GAAP or IFRS standards provides a foundation for resolving discrepancies.

- Utilize Software Tools: Leveraging technology like QuickBooks or Excel streamlines processes and reduces human error.

- Regular Training: Stay current with workshops and webinars to keep skills sharp and confidence high.

Developing Solutions-oriented Thinking

Adopting a solutions-oriented mindset is pivotal. This approach involves a few key steps:

- Identify the Issue: Begin by pinpointing the exact nature of the problem.

- Analyze Data: Delve into financial records and analyses to understand the problem's scope.

- Brainstorm Solutions: Generate multiple potential fixes to evaluate.

- Implement and Review: After choosing the best solution, apply it and monitor the results.

This mindset not only improves performance but also enhances your value as an accounting professional.

Keeping Abreast Of Regulatory Changes

As an accounting professional, staying up-to-date is crucial. The landscape of laws and regulations is ever-changing. To excel in accounting, it is vital to master navigating these changes. This section covers how to keep current with accounting rules and standards.

Understanding Tax Laws And Regulations

Tax laws can be complex and daunting. To comprehend the nuances, consider the following:

- Attending workshops offers interactive learning opportunities.

- Subscribing to accounting journals provides the latest tax updates.

- Joining professional bodies can help with resources and networking.

Regularly reviewing the IRS website is essential, as it is the primary source for tax law information.

Compliance With Evolving Accounting Standards

Accounting standards guide the integrity of financial reporting. They evolve to reflect economic realities.

- Stay informed through continuous professional education courses.

- Use online resources, like the FASB website, to stay aware of updates.

- Implement changes in your accounting practices promptly to maintain compliance.

Always check the effective dates for new standards to ensure timely adherence.

Fine-tuning Attention To Detail

Attention to detail is vital in accounting. It means tracking every figure and transaction. This can mean the difference between accurate records and costly mistakes. Now let’s explore how to enhance this crucial skill.

Minimizing Errors In Financial Reporting

Financial reports must be error-free. Begin with these steps:

- Review past errors. Learn from them.

- Use checklists for each financial process.

- Create templates for repetitive transactions.

- Double-check data entry. Always reconcile.

- Utilize accounting software. It helps prevent mistakes.

Quality Control In Accounting Processes

Implement a quality control system for accounting tasks. It includes:

| Step | Action |

|---|---|

| 1 | Set clear standards. Detail each accounting process. |

| 2 | Train staff regularly. Keep skills up-to-date. |

| 3 | Regular audits. Schedule them frequently. |

| 4 | Get feedback. Team insights can improve procedures. |

Effective Time Management For Accountants

Mastering the tick-tock of the clock is crucial for every accountant. A well-oiled schedule means more than just meeting deadlines. It boosts efficiency and lets you shine in the high-precision world of accounting. Let's delve into two key strategies that can elevate your time management game.

Prioritizing Accounting Tasks Efficiently

To conquer the clock, start with a plan for your day. Break it down into tasks. Some tasks need immediate attention, while others can wait. Here's how to tackle them:

- Distinguish Urgent from Important: Urgent tasks are time-sensitive. Important tasks impact your long-term goals. Know the difference.

- Use the ABC Method: A for 'must do', B for 'should do', and C for 'could do'. Prioritize accordingly.

- Set Realistic Deadlines: Assign time slots to tasks based on their priority.

Reducing Overwhelm With Organizational Tools

To trim down the chaos, embrace organizational tools. They are lifesavers. Here are some suggestions to get you started:

- Task Management Software: Tools like Asana or Trello can help you visualize your workflow.

- Email Management Apps: Sort your inbox quickly with apps like Outlook or Gmail filters.

- Online Calendars: Google Calendar is a great way to keep track of your appointments.

Remember, a tool is only as good as how you use it. So, keep them updated and check them daily.

Cultivating Communication Skills For Accountants

Strong communication skills are vital for accountants to succeed. These skills help accountants share financial data accurately and effectively. They also create positive relationships with clients and colleagues. Learning to communicate well can lead to better job performance and career opportunities.

Explaining Financial Information Clearly

To excel in accounting, clarity in explaining financial information is essential. Accountants must simplify complex data for clients and colleagues who may not be as numbers-savvy, ensuring they understand.

- Break down technical jargon into simple terms.

- Use visuals like charts and graphs to illustrate points.

- Provide examples to clarify complex concepts.

- Rehearse explanations to ensure fluency in communication.

Building Rapport With Clients And Colleagues

Building strong relationships is key to successful accounting. This trust leads to more referrals and cooperative work environments.

| Strategy | Benefit |

|---|---|

| Active Listening | Understand client needs better. |

| Regular Updates | Keep clients informed and involved. |

| Personalization | Show appreciation with tailored communications. |

Start conversations with a smile. Remember details about clients' lives. Recognize achievements and milestones of colleagues.

The Benefit Of Certifications In Accounting

Earning a certification in accounting is a smart step for any professional. Certifications open doors to advanced positions and higher salaries. They prove expertise and dedication. In today's competitive job market, these credentials can set you apart from the crowd.

Exploring Cpa And Other Accountancy Certifications

The CPA or Certified Public Accountant credential is a gold standard in accountancy. Several other certifications also enhance your skill set. Examples are CMA, CIA, and ACCA. Each offers a unique advantage and specialization.

| Certification | Specialization | Benefits |

|---|---|---|

| CPA | Tax and Regulations | Global recognition, trust from employers |

| CMA | Management Accounting | Better decision-making skills, strategic thinking |

| CIA | Internal Auditing | Expertise in risk management, improves auditing skills |

| ACCA | Global Accounting | Wide-ranging skills, flexibility across roles |

How Certifications Can Propel Your Career

Certifications are powerful career boosters. They validate skills and show a commitment to growth. Certifications can lead to promotions and enable entry into specialized fields. Here's how they can propel your career:

- Increased Earning Potential: Certified professionals often earn more.

- Professional Credibility: They are seen as experts and trustworthy.

- Expanded Job Opportunities: Access to a broader range of roles opens up.

- Networking Benefits: Joining professional bodies helps build connections.

Start with identifying which certification aligns with your career goals. Then, invest in study materials, courses, or training programs. Remember, passing these exams requires discipline. Consistent study and practical experience yield success.

Embracing Ethics And Integrity In Financial Reporting

Embracing Ethics and Integrity in Financial Reporting is crucial. Every accountant must adhere to high standards. These standards help build trust. They ensure accurate financial reports. Let's dive into how you can uphold these principles.

The Pillars Of Ethical Accounting

Ethical accounting stands on key pillars. They shape trustworthy accounting practices. Understanding these pillars is the first step to improve your accounting skills.

- Honesty: Always be truthful in reporting.

- Objectivity: Make decisions without bias.

- Professional Competence: Keep skills up-to-date.

- Confidentiality: Protect sensitive information.

- Fairness: Present accurate financial statuses.

Avoiding Fraudulent Reporting

Fraudulent reporting can devastate a company. Prevention is a key skill. Learn to spot red flags in financial data.

| Action | Description | Benefit |

|---|---|---|

| Consistent Reviews | Check reports regularly for errors. | Reduces error risk. |

| Clear Policies | Create guidelines for all financial processes. | Sets firm reporting standards. |

| Regular Training | Educate staff on ethics and fraud detection. | Empowers employees to act ethically. |

By implementing these strategies, you strengthen your role. You help create a culture of transparency and trust.

Mastering Advanced Accounting Topics

To excel in the finance world, diving into advanced accounting establishes expertise and credibility. Here, we explore complex topics that set you apart from the crowd. Enhance your skill set, make informed decisions, and become an indispensable asset to your team or clients.

Diving Into Forensic Accounting

Forensic accounting is the Sherlock Holmes of finance. It combines detective work with fiscal knowledge to uncover truths hidden in financial statements. Bold moves in this niche can lead to unravelling complex financial puzzles.

- Study anti-fraud controls and legal aspects.

- Learn data analysis techniques to spot anomalies.

- Engage in continuous case study reviews for practical insights.

Understanding International Financial Reporting Standards (ifrs)

IFRS are the passports for accountants in the global market. They harmonize reporting world over. Be proactive and deepen your understanding of these standards to ensure global compliance and recognition.

| Focus Areas | Study Tips |

|---|---|

| IFRS Fundamentals | Enroll in specialized courses or webinars. |

| Comparative Analysis | Examine the differences between IFRS and local GAAP. |

| Practical Application | Practice with real-world scenarios and case studies. |

Utilizing Financial Modeling For Future Projections

Mastering financial modeling helps you see your business's future. Craft a robust financial plan with these skills. Financial models make data-driven decisions simpler. Start improving your accounting skills with these model types.

Building Models For Budgeting And Forecasting

Creating accurate budgets and forecasts is a core skill in finance. These models help predict financial outcomes. Use them to plan expenses, revenues, and cash flows. To begin:

- Define your time frame: Decide whether monthly, quarterly, or yearly models fit your business.

- Gather historical data: Use past performance to shape future budgets.

- Consider market trends: Analyze external factors that might influence your figures.

Excel is a popular tool for creating these models, but many software options exist.

Scenario Analysis And Risk Assessment

Understand different financial outcomes with scenario analysis. It allows you to prepare for various future events. Risk assessment models identify potential problems before they occur. Here's how to implement:

- Create a base case scenario: Your expected financial outcome.

- Add alternative scenarios: Best-case and worst-case projections.

- Quantify risks: Assign probabilities to the different outcomes.

Use these tools to mitigate risks and make informed decisions.

Developing Leadership Skills For Senior Accounting Roles

Developing Leadership Skills for Senior Accounting Roles is pivotal for those aiming to reach the pinnacle of their accounting careers. Leadership in accounting does not only entail being adept with numbers but also mastering the art of guiding a team and making strategic decisions. This journey requires continuous learning, interpersonal skill enhancement, and a strategic mindset to effectively lead an accounting department.

Leading An Accounting Team Effectively

To lead an accounting team with proficiency, focus on these key elements:

- Communication: Convey goals and expectations clearly to your team members.

- Delegation: Assign tasks wisely to leverage each member's strengths.

- Support: Offer guidance and feedback to foster a collaborative environment.

- Recognition: Acknowledge achievements to motivate and retain top talent.

Effective leaders also invest in training programs to advance their team's skill set. They encourage continuous learning to keep up with the latest accounting trends and regulations.

Decision-making And Strategy In Accounting Leadership

Strategic decision-making is a core function of accounting leadership. It involves:

- Evaluating financial data to forecast potential outcomes of business decisions.

- Making informed choices that support the company's long-term goals.

- Implementing systems to track progress and pivot strategy when necessary.

Senior accounting leaders rely on a combination of financial acumen, critical thinking, and practical experience to steer their organizations toward fiscal success. Mastery over accounting software and tools is also essential to analyze data efficiently.

Engaging In Continuous Learning And Self-improvement

Stepping up your accounting skills requires a commitment to growth. The field is dynamic. New regulations, technologies, and methods evolve constantly. Embrace continuous learning to stay ahead. This approach ensures your expertise remains relevant and sharp.

Staying Informed On Best Practices

Accounting professionals must stay ahead. Regular updates in industry standards and technology are crucial. Keep your skills on point by:

- Attending workshops and seminars - Gain insights from experts.

- Subscribing to accounting journals - Get the latest research data and trends.

- Participating in webinars - Convenient, up-to-date learning.

- Networking - Share knowledge with peers.

Personal Development Plans For Accountants

Personal Development Plans (PDPs) guide your learning journey. Craft a plan with clear goals:

- Identify skills you wish to improve or learn.

- Set measurable objectives.

- Choose resources and actions for learning.

- Review progress regularly.

A well-structured PDP sharpens your skills systematically. It transforms learning into a strategic, manageable process.

|

| www.patriotsoftware.com |

Measuring Progress And Setting New Accounting Goals

Improving accounting skills is a journey of continuous learning and growth. An essential part of this journey is evaluating current abilities and setting fresh objectives to enhance proficiency.

Benchmarking Your Skill Development

Benchmarking is like having a map for your accounting skills.

- Identify key skills: List the skills pivotal to accounting success.

- Assess current level: Use tests or feedback to know where you stand.

- Compare with peers: See how your skills match up with others.

- Set achievable targets: Define what you want to improve.

- Track regularly: Check your progress often to stay on course.

Planning For Long-term Career Advancement

Think of your career as a ladder where each skill takes you higher.

- Visualize your career path: Picture where you want to be in the future.

- Acquire new qualifications: Consider certifications that can open doors.

- Gain diverse experience: Work on different projects to broaden your knowledge.

- Network with professionals: Connect with experts who inspire you.

- Update your goals annually: Keep refining your objectives as you grow.

| Year | Skill to Develop | Expected Milestone |

|---|---|---|

| 1st Year | Basic bookkeeping | Complete handling of company ledgers |

| 2nd Year | Financial analysis | Contribute to financial strategy meetings |

| 3rd Year | Advanced tax planning | Implement tax savings for clients |

Use this framework to measure progress and propel yourself towards long-term career objectives in accounting.

Read More,

Why You Need an Enterprise Seo Agency

30 Best Affiliate Programs for Earning

Frequently Asked Questions Of How To Improve Your Accounting Skills

Can Online Courses Enhance My Accounting Skills?

Yes, online courses can significantly boost your accounting skills. They offer flexibility and a wide range of topics from basic bookkeeping to advanced financial analysis. Choose courses with positive reviews and relevant certifications to ensure quality learning.

What Are Essential Accounting Skills To Learn?

Key accounting skills include proficiency in bookkeeping, understanding financial statements, and mastery of accounting software. Strong analytical abilities and attention to detail are also crucial. Continually update these skills to stay relevant in the field.

How Can I Practice Accounting More Effectively?

Practice accounting effectively by applying your skills in real-life scenarios. Use simulation software or volunteer for local businesses or nonprofits. Regularly review industry literature, and stay updated with accounting standards and regulations. This hands-on approach will solidify your knowledge and skills.

What Books Should Accountants Read To Improve?

Accountants should read books that cover fundamental principles, advanced techniques, and the latest financial regulations. Titles such as "Accounting Made Simple" by Mike Piper or "Financial Shenanigans" by Howard Schilit provide excellent insights. Choose books that are well-reviewed and updated regularly.

Conclusion

Sharpening your accounting skills is pivotal for career advancement and financial acumen. Embrace continuous learning, practical exercises, and updated software proficiency. Remember, persistence and dedication are key to mastering the numbers game. Start implementing these strategies today for a brighter, more confident financial future.

Post a Comment