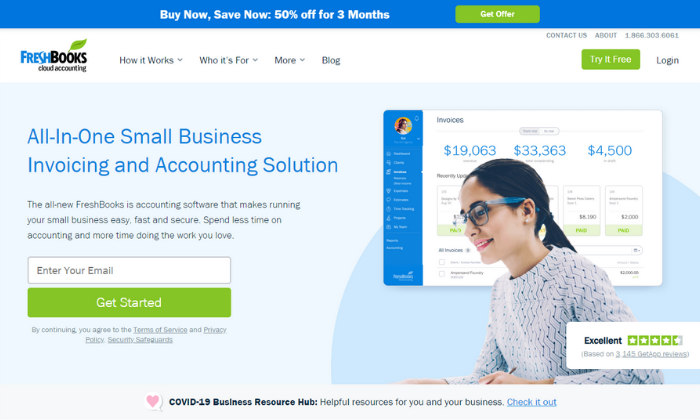

FreshBooks remains a top choice as an accounting tool in 2024. Its user-friendly platform and comprehensive features streamline financial tasks for many businesses.

In the competitive world of accounting software, FreshBooks has continuously shone as a beacon for small to mid-sized enterprises and freelancers needing an intuitive, reliable financial management solution. With an emphasis on automation, this cloud-based tool alleviates the mundane tasks of billing, expense tracking, and time management, providing entrepreneurs the invaluable gift of time.

Its real-time reporting capabilities empower business owners with instant insights into their fiscal health, making crucial decisions both informed and timely. In an ever-evolving digital landscape, FreshBooks' commitment to innovation and customer support helps users navigate the complexities of accounting with confidence, positioning this software as a preferred choice among its peers.

Exploring the digital accounting landscape, this Freshbooks review delves into features and user experiences to assess its standing in 2024. Discover if Freshbooks reigns supreme as your go-to accounting software with our comprehensive analysis.

Navigating the complex world of accounting can be a daunting task for entrepreneurs and small business owners. This is where Freshbooks steps in, with its user-friendly interface and robust feature set that aim to streamline financial management. Whether you're invoicing clients or tracking expenses, Freshbooks promises to simplify your accounting process.

But does it deliver on these promises? Let's take a closer look and find out if Freshbooks is the accounting tool you need in 2024.

Ease Of Use:

Freshbooks has long been acclaimed for its intuitive user experience. The platform is designed with simplicity in mind, allowing users to quickly adapt to its functions:

- User Interface: Clean and uncluttered, making navigation straightforward for users of all experience levels.

- Setup Process: Fast and hassle-free, ensuring new users can get started with their accounting without delays.

- Learning Curve: Minimal, thanks to the plethora of resources and support provided.

Comprehensive Accounting Features:

When discussing the mechanics of accounting software, the breadth and depth of its features often come to the forefront:

- Invoice Management: Generate professional-looking invoices and handle billing cycles with ease.

- Expense Tracking: Capture and organize expenses effectively, providing clarity on financial outgoings.

- Time Tracking: Ideal for service-based businesses that bill by the hour, improving accuracy in invoicing.

- Financial Reporting: Access a range of reports for insights into business performance.

Integrations And Add-ons:

Freshbooks doesn’t operate in isolation but integrates seamlessly with many other tools:

- Third-Party Apps: Connect with numerous applications, extending the functionality of Freshbooks beyond its core offerings.

- E-Commerce Platforms: Sync with online sales platforms to streamline revenue recording.

- Payment Gateways: Offers flexibility in how customers can settle their invoices, improving cash flow.

Pricing And Plans:

Pricing is a crucial factor for any business, and Freshbooks offers a range of plans to suit different needs and budgets. You’ll find options that cater to freelancers just starting out or growing businesses with more complex accounting demands:

- Tiered Pricing Structure: Choose a plan that matches the scale of your operations.

- Free Trial Availability: Test the waters with a no-obligation trial period before committing financially.

- Value for Money: Consider if the features provided justify the investment required.

Support And Resources:

The caliber of support can make a big difference, particularly when dealing with financial data. Freshbooks takes customer service seriously, offering several avenues of assistance:

- Customer Support: Reach out via email, phone, or live chat for help with any issues.

- Knowledge Base: A comprehensive library of articles to guide you through various functions.

- Community Forums: Share tips, ask questions, and get advice from fellow Freshbooks users.

Embarking on a journey with a new accounting tool can impact your business operations profoundly. As we delve into the intricacies of Freshbooks, remember that its potential to enhance your business's financial management is worth considering. Keep in mind the importance of compatibility with your business needs and the level of adaptability you require from an accounting tool in 2024.

Who Is Freshbooks Best For?

FreshBooks shines for small businesses and freelancers seeking intuitive and streamlined accounting solutions. Its user-friendly interface and time-saving features make financial management accessible, even for those with limited accounting experience.

Are you a freelancer juggling multiple clients or a small business owner striving to keep your finances in check? Pinpointing the right accounting tool can feel like searching for a needle in a haystack. Let's dive into what makes FreshBooks an option worth considering for particular users in the financial management landscape of 2024.

FreshBooks has positioned itself as a friendly and functional accounting solution, but it truly shines for certain groups of users.

Small Business Owners:

- Ease of Use: Operating with a minimalistic and intuitive interface, FreshBooks allows business owners to streamline their accounting tasks without requiring expert knowledge.

- Time Tracking: Invoicing is a breeze with built-in timesheets that enable one-click billing for hours worked, a boon for service-based businesses.

Freelancers:

- Customizable Invoices: Offering tailor-made invoice templates, FreshBooks helps freelancers professionalize their billing with personalized branding and payment terms.

- Mobile Accessibility: With a robust mobile app, freelancers on the go can manage finances from anywhere, making sure they don't miss a beat.

Agencies:

- Project Collaboration: Teams can collaborate seamlessly on projects with time tracking and expense logging within the same platform.

- Client Management: Agencies can manage client retainers efficiently, set clear expectations, and automate recurring billing cycles with ease.

Creative Professionals:

- Simplified Expense Tracking: Artists and designers can capture receipts through the app and organize expenses without a fuss.

- Payment Options: FreshBooks supports a variety of payment gateways, ensuring that creative pros can receive payments in their preferred methods.

With a zesty combination of adaptability and user-centric features, FreshBooks establishes itself as a competitive choice for those who prioritize ease, accessibility, and efficient client management. Whether you're a solo entrepreneur or running a full-fledged team, assessing your needs against FreshBooks' offerings could lead you to a tool that aligns with your business aspirations.

How Much Does Freshbooks Cost?

FreshBooks offers flexible pricing, with plans starting around $15 per month for basic features. Businesses seeking advanced functionalities can expect higher costs, adapting to their growing needs.

Freshbooks Pricing Explained

Selecting the right accounting tool can be pivotal for your business, and price is a significant factor for any decision maker. Now, FreshBooks offers various pricing tiers to accommodate the diverse needs of freelancers, small business owners, and growing companies alike.

Let's break down the cost structure to see if FreshBooks aligns with your budget for 2024.

Freshbooks Plan Options

Finding a suitable accounting solution means understanding what you're getting for your investment. FreshBooks packages are tiered as follows:

- Lite Plan:

- Ideal for self-employed professionals managing a small client base.

- Allows for invoicing up to 5 clients.

- Plus Plan:

- Designed for small businesses looking to expand their operations.

- Includes invoicing for up to 50 clients and additional features such as payment reminders.

- Premium Plan:

- Tailored for growing businesses with a larger clientele.

- Supports invoicing for up to 500 clients and gives access to advanced reporting features.

Pricing for each plan increases incrementally, reflecting the enhanced capabilities and extended client limits. It's crucial to assess which features are a must-have for your business to ensure you're getting the best value.

Additional Costs And Add-ons

While the core plans cover most accounting needs, FreshBooks also offers extra services to boost your financial management experience. Let's delve into what additional expenses might look like:

- Advanced Payments:

- This add-on enables you to accept credit card payments directly on your invoices and set up recurring billing.

- Team Members:

- Additional fees apply per team member added to your account, facilitating collaboration but increasing the overall cost.

- Personalized Onboarding:

- For businesses looking for tailored setup assistance, FreshBooks offers personalized onboarding services at a premium.

Consider these extras as investments in efficiency and scalability. They aren't mandatory, but for some businesses, they could be the difference between good and great financial management.

Free Trial And Money-back Guarantee

Easing into a new accounting software should come without risks, and that’s where FreshBooks' user-friendly approach shines through. Every new signup is entitled to:

- A free 30-day trial period:

- Test every feature without any payment information required upfront.

- An opportunity to see firsthand if the interface and functions meet your needs.

- A no-hassle money-back guarantee:

- If you opt for a paid plan but find FreshBooks isn't the right fit, they offer a refund policy that respects the user's choice and investment.

This transparent approach aims to prioritize user satisfaction, which, frankly, is as appealing as the features themselves. Carefully consider these risk-free options when weighing FreshBooks against your 2024 accounting needs.

Is Freshbooks Safe?

Evaluating FreshBooks for both security and functionality, it emerges as a trustworthy contender in the accounting software arena. Its robust encryption and diligent data protection protocols ensure users' financial information remains secure, maintaining peace of mind for businesses throughout 2024.

Choosing the right accounting tool is crucial for businesses of all sizes seeking to streamline their finances. In the ever-evolving landscape of financial software, FreshBooks emerges as a robust contender in 2024. But one critical aspect users often ponder before opting for a service is security.

Understanding the safety measures of an accounting platform is as important as evaluating its features and user-friendliness.

Is Freshbooks Secure?

FreshBooks prioritizes the security of its users' data with a multifaceted approach:

- Encryption technology:This includes the use of industry-standard secure socket layers (SSL) encryption, ensuring that all data sent between your device and FreshBooks servers is protected from unauthorized access.

- Regular audits:FreshBooks undergoes frequent security audits, performed by third-party experts, to uphold stringent data protection standards and identify potential vulnerabilities.

- Compliance certifications:FreshBooks is committed to maintaining compliance with relevant regulations, including GDPR for European users, which dictates strict standards for data security and privacy.

Diving into the security specifics, FreshBooks not only implements rigorous measures but also fosters a culture of transparency by regularly updating its users on privacy policies and security practices. This transparency reassures users about the safety of their financial data while reinforcing FreshBooks' dedication to upholding the highest security standards.

User Role Management And Permissions:

When multiple team members access an accounting tool, managing their permissions becomes essential to maintain data integrity. FreshBooks acknowledges this with:

- Customizable user roles:Users can tailor access for team members based on their role within the organization, ensuring sensitive information remains accessible only to authorized personnel.

- Detailed permission settings:The power to define capabilities for each role allows account owners to enforce a clear separation of duties, effectively minimizing the risk of internal data breaches.

By delivering a customizable and secure environment, FreshBooks facilitates not just ease of use but peace of mind. Its robust role management system stamps out undue concerns about insider threats and equips business owners with a reliable framework to oversee financial data.

Embracing technological advancements and customer feedback, FreshBooks consistently improves its security features. This approach to safety cements its place as a leading accounting tool in 2024 and beyond, allowing business owners to focus on growth rather than the security of their financial information.

What Can I Do With Freshbooks?

FreshBooks simplifies accounting for small business owners with invoicing, expense tracking, and time management features. It streamlines financial processes, potentially making it a top accounting tool choice for 2024.

User-friendly Invoicing

FreshBooks shines as an invoicing powerhouse, offering businesses the ability to create and send polished invoices with just a few clicks. What's more impressive:

- Customizable templates: Tailor your invoice appearance to match your brand, ensuring a professional image with every transaction.

- Automated billing: Set up recurring billing cycles for regular clients, saving you time and ensuring timely payments.

- Multi-currency invoicing: Bill international clients effortlessly by invoicing in their local currency.

With these features, FreshBooks ensures that managing invoices is no longer a daunting task but rather a streamlined aspect of your business.

Efficient Time Tracking

Keeping tabs on how you or your team spend working hours can be cumbersome without the right tools. Fortunately, FreshBooks offers a solution that is both straightforward and effective in tracking time with precision. You can anticipate:

- Simple time entry: Log hours spent on various projects quickly and without hassle.

- Integrated timer: Use built-in timers to record billable hours in real-time, directly within the platform.

- Detailed reporting: Analyze time spent on projects to improve productivity and billing accuracy.

Time tracking with FreshBooks is so intuitive that it feels like having a personal time management assistant, ensuring you never lose track of billable hours again.

Comprehensive Project Management

Browsing through the features of FreshBooks, you'll soon see that it's more than just an accounting tool; it's a comprehensive project management suite. Users benefit in a myriad of ways:

- Project collaboration: Work with your team and clients within FreshBooks to share files, discuss the project, and provide updates all in one place.

- Budget management: Keep your project expenses under control by setting a budget and tracking progress against it.

- Time-to-project linking: Allocate tracked time to specific projects for better organization and invoicing accuracy.

FreshBooks makes project management a breeze, proving that monitoring the progression of your tasks can be both effective and enjoyable.

Insightful Financial Reporting

Understanding your business's financial performance is crucial, and FreshBooks offers potent reporting tools. These tools provide:

- Profit and loss statements: An essential overview of your business’s financial health.

- Tax summary reports: Tax preparation becomes easier with a detailed breakdown of taxable income.

Armed with FreshBooks' robust reporting features, you're empowered to make informed business decisions backed by accurate financial data.

Cloud-based Accessibility

In the digital era, the ability to access your accounting software from anywhere cannot be overstated. FreshBooks harnesses the power of the cloud, providing:

- Cross-device synchronization: Access your account from any device, keeping your data synced and up-to-date.

- Security: Rely on industry-standard secure data encryption to keep your sensitive financial information safe.

- Regular updates: Benefit from new features and improvements without any manual software updates.

With cloud-based flexibility, FreshBooks ensures that your accounting records are as mobile as you are, providing peace of mind and seamless integration into your daily workflow.

Time Tracking

Efficient time tracking in Freshbooks simplifies invoicing and enhances productivity, a crucial aspect in our comprehensive Freshbooks review. Explore why this feature bolsters its standing as a top contender for the best accounting tool in 2024.

Searching for a reliable accounting tool that can seamlessly track time while managing finances may seem daunting, but Freshbooks might just be the one-stop solution you've been searching for in 2024. Offering a multitude of features with an emphasis on user-friendliness, it's intriguing to dive into the specifics and see how it fares, particularly in the realm of time tracking.

Features

Freshbooks boasts an array of time tracking attributes designed to simplify your work life:

- Easy to Use Timer: Initiate a timer with a single click. Perfect for freelancers and consultants, this feature records every billable minute as you work.

- Team Time Tracking: Keep tabs on your team's work hours effortlessly. This aids in project management and ensures accurate invoicing for clients.

- Integrated Invoicing: With one click, transfer recorded time to invoices. This streamlines billing and ensures you're compensated for every hour worked.

Time Tracking Benefits

When analyzing the benefits of Freshbooks' time tracking capabilities, they noticeably enhance productivity and financial management:

- Enhanced Productivity: By monitoring how much time is dedicated to each task, categorizing activities becomes simpler, letting you pinpoint which tasks are both time-consuming and profitable.

- Transparent Billing: Clients appreciate transparency. Detailed time tracking clarifies for clients where their investment goes, strengthening trust and potentially leading to more business.

The user-friendly nature of Freshbooks’ time tracking not only streamlines the process of recording hours but also integrates perfectly with other features for a well-rounded accounting experience. So, if efficient time management and accurate billing are on your radar for 2024, Freshbooks might just be the tool to keep your financials in check.

Project Management

Explore the ins and outs of Freshbooks in our latest review, uncovering if it reigns as the top accounting software for 2024. Discover insightful perspectives on how Freshbook's features streamline project management for businesses of all sizes.

Capabilities In Freshbooks

When choosing an accounting tool that doubles as a project management solution, Freshbooks brings a lot to the table. It extends beyond simple accounting features and delves into the realm of comprehensive project oversight. With Freshbooks, you have the ability to track every facet of your project, ensuring that nothing falls through the cracks.

- Time tracking: Freshbooks provides a straightforward approach to monitoring the hours spent on each project. Users can easily start and stop timers or manually enter their work hours, making invoicing for time spent a breeze.

- Collaborative workflow: Team members can collaborate in real-time, sharing files, discussing project updates, and leaving feedback. This feature fosters a cohesive working environment, regardless of team members' physical locations.

- Budget management: Stay in control of your project finances with budget tools that help prevent scope creep. Tracking expenses against your budget ensures projects remain profitable.

- Deadlines and deliverables: Set clear deadlines and milestones within Freshbooks to keep everyone aligned towards the project goals. Visual progress indicators help keep tasks on track and clients informed.

How Freshbooks Enhances Project Productivity

Organizing your projects is effortless with Freshbooks' user-friendly interface— you can streamline operations, improving overall productivity. The tool’s design is focused on helping users manage their work efficiently while maintaining the flexibility to adapt to project-specific needs.

- Client communication: Initiate conversations directly with clients through Freshbooks. This centralizes communication and enables quick resolution of inquiries, contributing to enhanced client satisfaction.

- Customizable due dates and reminders: Tailor due dates for invoices or project steps and set reminders to keep your schedule on point. This personalization avoids missed deadlines and keeps the project flowing smoothly.

- Reporting insights: Generate comprehensive reports outlining project performance, financial health, and team productivity. These insights can guide future business decisions and strategies.

- Seamless integration: With its ability to integrate with other tools, Freshbooks connects every aspect of your daily operations. It augments the natural workflow, minimizing the need for external apps or software.

Freshbooks equips businesses with the project management tools required to succeed. From detailed time tracking to enhancing productivity through insightful reporting, it's designed to elevate your project management experience in 2024.

Invoices

Freshbooks simplifies the invoicing process, ensuring effortless management of business finances. Our comprehensive review reveals whether it's the top accounting software choice for 2024, streamlining payment collection and expense tracking.

Invoice Customization And Branding

Crafting an invoice isn't just about numbers; it's a direct reflection of your business. Freshbooks understands this and has put a great emphasis on the customization aspects of its invoicing feature. Let's dive into how you can infuse your brand's identity into your invoices:

- Logo incorporation: Your logo can be easily uploaded to Freshbooks to sit proudly on your invoices, ensuring brand recognition.

- Color schemes: Match your invoice's look to your brand by selecting custom color palettes that resonate with your business's aesthetic.

- Payment terms and conditions: Tailor your payment requirements by specifying your preferred terms and conditions directly on the invoice.

Streamlined Invoice Management

Sending invoices is one thing—managing them effectively is another. Freshbooks presents a solution that empowers users to handle their billing with ease. Here's what you can expect from the system's invoice management capabilities:

Standing at the heart of every business transaction, invoices need to be created, sent, and tracked efficiently. Freshbooks offers a robust management system that facilitates a seamless billing process. You are afforded the tools to:

- Track invoice statuses: Keep a close eye on which invoices have been paid, are due, or are overdue without sifting through countless files.

- Automate reminders: Set up automatic email reminders to gently nudge clients about upcoming or missed payments, trimming down your administrative tasks.

- Manage recurring payments: If you have regular clients, Freshbooks can automate recurring invoices, saving you time each billing cycle.

Time-saving Automation Features

Who doesn't want to save time and reduce manual workload? Freshbooks includes intelligent automation that streamlines the invoicing process from start to finish. Get to know the automation features that can benefit your business:

In the realm of accounting, time is indeed money, and Freshbooks' automation capabilities rise to meet the efficiency challenge. The following features are designed to streamline your financial workflow:

- Automatic tax calculations: Freshbooks can calculate the appropriate taxes for your invoices based on your location and business type.

- Payment schedules: Set up a payment schedule to automatically charge your client's card in increments, over time.

- Late payment fees: Should a client fail to pay on time, Freshbooks can auto-apply late fees to the outstanding invoice for you.

By harnessing these features, business owners can ultimately focus more on running their enterprise and less on mundane billing tasks. Freshbooks shows promise to those seeking a reliable, user-friendly accounting tool that understands the nuances of effective invoice management. As we evaluate whether it's the best accounting tool to use in 2024, these invoicing features are a strong contender in its favor.

Inventory Tracking

Seamless inventory tracking is pivotal in managing a business's resources effectively, and Freshbooks ensures no detail is overlooked. The robust accounting software offers intuitive tools that simplify stock monitoring, essential for the fiscal health of any enterprise in 2024.

Comprehensive Inventory Management

When operating a business, keeping tabs on your inventory is crucial for maintaining a balanced supply chain. Freshbooks, in its latest iteration, recognizes this need and addresses it efficiently. It allows users to monitor their stock levels, track goods sold, and gain insight into popular products, ensuring that they are neither overstocked nor understocked.

Detailed Tracking Capabilities:

- Real-time updates: Each sale or purchase order automatically adjusts inventory levels, offering up-to-date information on what's in stock.

- Alert system for low stock: Receive notifications when items are running low, allowing for timely reordering before a shortage occurs.

- Comprehensive reporting: Access insights into inventory trends, helping to forecast demand and manage seasonal fluctuations.

Keeping an inventory tracking system that is integrated with your accounting software simplifies the management process. With Freshbooks, you don't just manage finances; you maintain a comprehensive view of your business's operational health right down to the specifics of inventory.

This integration leads to smarter business decisions and an optimized workflow, streamlining both the financial and logistical aspects of your company.

Analytics And Reporting

Freshbooks revolutionizes financial management with robust analytics and reporting features. Its intuitive dashboards and comprehensive reporting empower users to make data-driven decisions for their businesses.

Navigating the complex waters of business finance can be daunting, but having a reliable tool can make all the difference. Freshbooks has positioned itself as a potential lifesaver for many businesses in 2024, offering robust analytics and reporting features that could ease the stress of number-crunching for entrepreneurs and finance managers alike.

Comprehensive Financial Dashboards

At the heart of Freshbooks' reporting capabilities lies its comprehensive financial dashboards. These dashboards transform raw data into visually appealing and digestible information, allowing users to quickly grasp their financial performance without delving into the minutiae. Key metrics like expenses, profits, and revenue trends are front and center, giving a high-level overview that’s crucial for swift decision-making.

Detailed Profit & Loss Reports

- Profit insight:Freshbooks breaks down your profitability with precision, offering insights into the most intricate details of your income and expenditure. You can effortlessly trace where your money is coming from and where it is headed.

- Loss investigation:Equally important is understanding the flip side of your finances. Loss reports are thorough, revealing areas that may require cost-cutting measures or strategic reallocation of resources.

Putting your business under the microscope might reveal surprising opportunities for growth and efficiency that you hadn't considered before. By dissecting the monetary flows within your company, Freshbooks empowers you to make informed choices that could be the key to unlocking your business's potential in the coming year.

Real-time Accounting Health Score

Freshbooks doesn't just regurgitate numbers; it interprets them for you. By calculating an accounting health score, it offers real-time insight into the wellbeing of your business finances. This score can help you understand the stability of your financial situation at a glance.

Think of it as a financial fitness tracker for your business – always there to give you an instant check-up on how well you're managing your money.

Advanced Reporting Filters

- Customizable data slices:Every business is unique, and Freshbooks understands this by providing advanced filtering options for reports. This customization means you can slice and dice the data based on dates, clients, projects, or even specific expenses.

- Time-saving templates:Time is money, and with predefined report templates, you save both. Tap into a range of templates catering to the most common reporting needs, streamlining the process of generating regular reports.

It's like having a personal analyst at your disposal, ensuring that you gather the most relevant insights to facilitate strategic decisions. By filtering out the noise, you are left with crystal-clear clarity on the metrics that matter most to you and your stakeholders.

Freshbooks' analytics and reporting tools in 2024 appear to be more than just a feature; they're a potential game-changer in the realm of financial management. They could very well provide the transparency and control necessary to navigate the financial challenges of running a business, putting powerful data-driven decision-making at your fingertips.

Freshbooks Vs. Other Top Accounting Programs

Navigating the sea of accounting software, FreshBooks stands out as a robust contender. It boasts user-friendly features and streamlined invoicing designed for both freelancers and growing businesses, prompting many to wonder if it's the top financial aide for 2024.

Choosing the right accounting software for your business can be a significant challenge, with various options vying for your attention. FreshBooks is a contender that often comes up in conversations about top accounting tools, especially as we head into 2024.

Let's dive into how it stacks up against other leading programs in the market.

Freshbooks Vs. Quickbooks

QuickBooks is frequently seen as the go-to accounting software, but FreshBooks has been carving its niche with some unique features. Both are robust platforms, yet they cater to different business needs.

- Market Presence: QuickBooks boasts a broader user base and industry recognition.

- Ease of Use: FreshBooks has a more intuitive interface, simplifying the accounting process for freelancers and smaller businesses.

- Features: QuickBooks offers more elaborate features suitable for larger enterprises, while FreshBooks focuses on essential functions with streamlined efficiency.

- Pricing: FreshBooks tends to be more cost-effective for the solo entrepreneur or small business, whereas QuickBooks can be a more scalable solution.

Freshbooks Vs. Xero

Navigating through accounting software solutions, Xero emerges as another strong alternative to FreshBooks. Both platforms exhibit user-friendly menus and valuable tools.

In a direct comparison with Xero, FreshBooks reveals its strengths as an accounting tool, particularly for those seeking simplicity and efficiency in their financial management processes.

- Target Audience: Xero gears its services towards a wider audience, including medium-sized businesses, compared to the freelancer and small business focus of FreshBooks.

- Customization: Xero's customizable options surpass FreshBooks when it comes to reporting and analytics.

- Third-party Integrations: While FreshBooks offers a respectable range of integrations, Xero leads with a more extensive ecosystem.

- Mobile Experience: FreshBooks provides a superior mobile app, designed for on-the-go invoicing and expense tracking.

Freshbooks Vs. Wave

If cost is a pivotal factor, Wave enters the scene as a highly competitive accounting program, challenging FreshBooks with its free pricing structure.

Unlike Wave, FreshBooks advocates for premium features that cater especially to those who necessitate advanced invoicing and time tracking tools. However, when considering basic accounting capabilities, Wave's zero-fee approach can be tempting for start-ups and entrepreneurs on a tight budget.

- Pricing Model: Wave's major draw is its no-cost policy, while FreshBooks operates on a subscription-based model.

- User Interface: Both platforms are designed with user-friendliness in mind, but FreshBooks leads slightly in customer support and ease of navigation.

- Scalability: FreshBooks offers more scalable plans for growing businesses that might eventually need more sophisticated features.

- Added Services: FreshBooks provides additional services like project management and client retention strategies, which are limited or absent in Wave.

Choosing the best accounting tool hinges on specific business requirements and preferences. FreshBooks presents a formidable package, especially for those prioritizing usability and customer service. As we assess the landscape of accounting software in 2024, consider your business's current and future needs to make the most informed decision.

Each program brings its own set of advantages to the table, so identifying what aligns with your operational workflow is paramount.

Freshbooks Vs. Sage

Exploring the 2024 accounting landscape, FreshBooks emerges as a robust contender, particularly when stacked against Sage's offerings. This comprehensive FreshBooks review highlights its potential as the go-to accounting tool for businesses seeking efficiency and user-friendliness.

Choosing the right accounting tool is crucial for managing your business finances efficiently. FreshBooks and Sage both offer robust features, but they cater to different business needs. Let's dive into the specifics to determine which one might be the best fit for you in 2024.

Freshbooks User Interface And Experience

- Simplicity and Intuitiveness: FreshBooks offers an extremely user-friendly interface, which is simple to navigate, even for those who aren’t particularly tech-savvy.

- Streamlined Workflow: Users appreciate the platform's efficient design, which streamlines invoicing and time tracking processes.

FreshBooks prides itself on its modern, clean interface that enhances user engagement. Its dashboard provides quick access to important metrics, ensuring that you can see your business's financial health at a glance.

Sage's Comprehensive Feature Set

- Extensive Functionality: Sage provides a broad range of features that can accommodate more complex accounting needs.

- Industry-Specific Solutions: It offers tailored solutions for various industries, giving businesses specialized tools for their accounting practices.

In contrast to FreshBooks, Sage often appeals to businesses looking for a more comprehensive suite of accounting tools. It's particularly beneficial for companies that require a higher level of customization and control over their financial reporting.

Pricing Models

FreshBooks promotes transparent pricing with plans that cater to entrepreneurs and small businesses:

- Forward-Thinking Pricing: Its pricing tiers are designed to grow with your business, allowing you to scale up as needed.

- Cost-Efficiency for Small Teams: Small businesses often find the cost of FreshBooks to be more favorable, especially when starting out.

Considering the financial investment in an accounting tool is essential. FreshBooks provides budget-friendly options particularly suitable for smaller businesses or freelancers. Its tiered pricing structure means you can start with the basics and add features as your business expands.

Sage's Customer Support And Resources

- Well-rounded Support: Sage's customer service includes extensive options such as phone support, live chat, and a resourceful online community.

- Valuable Learning Materials: Sage offers a wide range of educational materials, including webinars and training, to help users maximize the software's potential.

Sage understands the importance of support, providing its users with multiple avenues to get the assistance they need. By equipping customers with an array of learning tools, Sage ensures that businesses can make the most of its comprehensive accounting solutions.

Freshbooks Vs. Bonsai

Exploring FreshBooks for 2024's accounting needs? Our thorough analysis pits it against Bonsai, highlighting key differences for small businesses. Discover if FreshBooks outshines its competitors as the ultimate accounting solution.

Selecting the right accounting tool is crucial for managing business finances effectively. With a plethora of options available, it can be daunting to sift through the noise and find the perfect fit for your business needs. In 2024, two prominent contenders for your accounting solutions are FreshBooks and Bonsai.

Let's delve deeper into what sets these two apart.

Freshbooks: Tailored For Invoice-centric Businesses

FreshBooks started as an invoicing software and it still plays to its strengths:

- User-Friendly Interface: FreshBooks offers a clean and modern interface ensuring navigation simplicity and user comfort.

- Comprehensive Invoicing Features: Tailored toward invoice-related tasks with advanced options like customization, automatic billing, and multi-currency support.

- Time Tracking Integration: Directly tracks billable hours and attaches them to invoices for ease of billing clients.

While FreshBooks has widened its suite to include other accounting features, its core remains strongest at handling invoice-related tasks.

Bonsai: A Holistic Approach For Freelancers And Small Teams

Conversely, Bonsai presents itself as a more rounded platform:

- All-In-One Workflow: Combines contract creation, time tracking, and invoicing in a seamless flow, making it ideal for freelancers and small businesses.

- Strong Project Management Tools: Offers features like task management and deadlines, which synergize well with its accounting functions.

- International Payments: Bonsai supports global payments and helps with tax compliance, which is very beneficial for users handling international clientele.

Bonsai gears itself towards providing an inclusive platform that caters to the broader needs of project-based work and freelancing.

To sum it up, your choice between FreshBooks and Bonsai can align closely with the nature of your work. Do you need a sharp focus on invoicing, or a diversified tool to handle multiple aspects of your business? Both tools come with their strengths, and the choice ultimately hinges on which features align best with your business operations in 2024.

Is Freshbooks Better Than Quickbooks?

Exploring FreshBooks' capabilities reveals its strengths in user-friendly invoicing and time tracking, making it a strong contender for the best accounting tool in 2024. Contrasting FreshBooks with QuickBooks highlights the importance of choosing software that aligns with your business's specific needs.

When choosing an accounting tool, entrepreneurs and small business owners often weigh the options between FreshBooks and QuickBooks—two giants in the accounting software market. With each platform offering unique features, the decision might seem overwhelming. Let's explore how FreshBooks compares with its counterpart, QuickBooks, and decipher which could claim the title of the best accounting tool for 2024.

Ease Of Use: A Closer Look

FreshBooks has garnered attention for its user-friendly interface. Here's why some users may find it easier to navigate than QuickBooks:

- Intuitive design: FreshBooks offers a clear, streamlined user interface that simplifies navigation and ensures a lower learning curve.

- Automated tasks: From invoicing to expense tracking, the automation in FreshBooks can save users valuable time.

- Customer support: With a reputation for excellent customer service, FreshBooks makes sure help is readily available for its users.

Core Features: The Battle Of Capabilities

Let's examine the core features that each platform offers:

FreshBooks and QuickBooks both provide comprehensive accounting tools, but their focus on certain features can sway a user's preference:

- FreshBooks: Its strength lies in simplicity and automation, particularly for sole proprietors and service-based businesses. Features like time tracking and project management are seamlessly integrated.

- QuickBooks: Geared more towards a variety of business sizes, it includes extensive reporting features and inventory tracking, which can be critical for product-based businesses.

Pricing Strategies: Comparing Costs

When talking about pricing, FreshBooks and QuickBooks target different segments of the market:

- Affordability: FreshBooks comes across as more affordable for freelancers and small businesses due to its tiered pricing that grows with your business needs.

- Scalability: QuickBooks often ends up as the go-to choice for larger businesses that require more complex accounting solutions, despite its higher cost.

Mobile Accessibility: Accounting On-the-go

In today's fast-paced world, mobile access to accounting tools is non-negotiable for many users:

- FreshBooks shines with its mobile app, offering comprehensive functionality that rivals the desktop experience.

- QuickBooks also provides a robust mobile app, but some users find that not all features are as efficient as on the desktop version.

Integrations: Expanding The Ecosystem

Both platforms offer a range of integrations, but their approach differs:

- FreshBooks has chosen to integrate with a variety of third-party apps and software, making it more adaptable to specific workflows.

- QuickBooks, with a larger ecosystem, allows for integrations with many industry-specific solutions that may be indispensable for certain businesses.

User Reviews And Satisfaction: What The Users Say

Real user feedback is crucial. Here’s the sentiment among users:

- Community feedback: Many users express satisfaction with FreshBooks for its focus on ease of use and customer-centric approach.

- Professional endorsements: QuickBooks often receives high praise from accounting professionals for its extensive features and reliability.

Choosing the right accounting tool involves more than comparing feature lists; it requires considering your business model, size, and specific needs. As we look toward 2024, both FreshBooks and QuickBooks are evolving, continually adding features aimed at making business owners' lives easier.

At the heart of this competition is the end-user, whose requirements and feedback will ultimately shape the future of these platforms.

Freshbooks Vs. Zoho Accounting

Our FreshBooks review reveals it as a top contender for the best accounting tool in 2024, overshadowing Zoho Accounting with its intuitive interface and comprehensive features. Entrepreneurs praise FreshBooks for its seamless invoicing and time-tracking capabilities, vital for growing businesses aiming for financial clarity.

Searching for the ultimate accounting software can be a task akin to finding a needle in a haystack. Yet, this search is crucial for entrepreneurs who understand that robust accounting software is not just a tool—it's an ally in managing their business's financial health.

This brings us to a showdown that's on the minds of many savvy business owners and accountants alike: FreshBooks vs. Zoho Accounting. Which software wins the title of the best accounting tool to use in 2024? Let's dive into a detailed comparison.

Freshbooks: An Overview Of Features

FreshBooks is celebrated for its user-friendly interface, which makes navigating the complexities of financial management seem like a breeze. Let’s look at what it packs under the hood:

- Ease of Use: Designed as an intuitive platform, FreshBooks allows users to quickly create invoices, manage expenses, and track time with little to no learning curve.

- Mobile App Convenience: With a mobile app that mirrors the desktop's efficiency, manage your finances on the go without missing a beat.

- Invoice to Payment Automation: FreshBooks simplifies the process from invoicing to payment collections, enhancing the cash flow cycle efficiency.

- Insightful Reports: Gain valuable insights into your financial health through comprehensive reporting tools that are both accessible and easy to interpret.

Zoho Accounting: Strengths And Tools

Switching our focus to Zoho Accounting, this contender steps into the ring with a robust set of tools designed to meet the accounting needs of small to medium businesses.

Zoho Accounting shines with a suite of applications that integrate seamlessly to offer a full-fledged accounting solution. With capabilities that extend from simple invoice generation to complex financial management, Zoho Accounting is a heavyweight in its own right. The strength lies in its ability to cater to a range of financial tasks, making it an all-in-one platform for those who need more than just the basics.

Comparing Pricing Models

When it comes to the financial commitment of subscribing to an accounting software, pricing plays a pivotal role. Here's how FreshBooks and Zoho Accounting compare on the balance sheet:

- Subscription Tiers: FreshBooks offers a tiered pricing model, ensuring businesses only pay for the features they need while providing room to grow.

- Transparent Pricing: With clear breakdowns of each plan, users can anticipate monthly expenses without fear of hidden fees or surprise charges.

- Zoho's Bundle Advantage: Zoho Accounting is part of the larger Zoho suite, which could lead to cost savings if you're using multiple Zoho apps.

Usability And Customer Support

The real-world application of any tool lies in its usability and the support you receive when hurdles arise. In these departments, both FreshBooks and Zoho Accounting stand tall:

FreshBooks prides itself on exceptional customer service, with support readily available. The platform's minimalistic design ensures that users aren't bogged down by unnecessary features, fostering a more streamlined workflow. Zoho Accounting, meanwhile, offers extensive resources and community forums for peer-to-peer assistance, supplementing its official support channels.

Both services understand that quality support is not just about solving problems, it's about ensuring seamless, uninterrupted business operations.

The Final Verdict: Which Leads The Pack?

Choosing between FreshBooks and Zoho Accounting is like picking between two premium coffee blends—each has its unique flavor and appeal. FreshBooks may be your go-to for sheer simplicity and ease of use, while Zoho Accounting could be the choice if your needs are more expansive and you're already nestled in the Zoho ecosystem.

The decision ultimately hinges on your business's specific needs, budget constraints, and long-term financial management goals.

Embarking on the journey of selecting the right accounting software is no small feat. Each contender in this FreshBooks vs. Zoho Accounting battle offers distinctive advantages that could be the perfect fit for your entrepreneurial endeavours. With the details outlined, the power lies in your hands to make the informed choice that sets your business on a path to fiscal precision and growth.

Is Freshbooks Legit? A Look At Freshbooks Reviews

Exploring FreshBooks reviews, many users confirm its legitimacy and efficacy as a top accounting tool for 2024. Diverse testimonials highlight its ease of use and comprehensive features, suggesting it's an excellent choice for managing finances efficiently.

When scouting for accounting tools, the validity and reliability of the platform is a critical factor for entrepreneurs and small businesses. FreshBooks, a cloud-based software, has garnered attention for streamlining accounting tasks. Let's dive into its credibility.

Freshbooks Reviews: What Do Users Say?

The verdict from users offers valuable insight into FreshBooks' legitimacy:

- User Interface and Experience: FreshBooks boasts an intuitive and user-friendly interface, simplifying accounting for non-accountants.

- Customer Support: Clients frequently praise the responsive and helpful customer service team that's readily available to assist with queries.

- Feature Set: Numerous testimonials highlight the comprehensive toolset, from invoicing to expense tracking, as being notably efficient.

Is Freshbooks Recognized By Experts?

Industry experts have also weighed in on FreshBooks, lending it further legitimacy:

Expert endorsements lend significant weight to FreshBooks' credibility. Recognized with several awards, it's not only popular among small business owners but also praised by those in the know for its capabilities and customer service excellence.

- Recognition and Awards: FreshBooks has received multiple accolades from reputable institutions, endorsing its quality and performance.

- Continuous Improvement: Regular updates demonstrate commitment to staying current and improving functionality for users.

- Security Measures: With robust security protocols in place, FreshBooks has been deemed as reliable and secure by cybersecurity specialists.

Prospective users can rest assured that FreshBooks isn't just another tool in the market. It stands out both through user experiences and industry expert evaluations, signifying it as a trustworthy and effective solution for accounting needs in 2024.

Why You Can Trust Our Analysis Of Freshbooks

Our FreshBooks analysis is based on rigorous testing and real-world user feedback, ensuring authenticity and reliability. Trust our review to decide if FreshBooks is the ultimate accounting tool for your 2024 business needs.

Choosing the right accounting software can feel like navigating a maze, but with a thorough analysis of FreshBooks, we're here to illuminate the path to an informed decision. As we plunge into the specifics of FreshBooks, understand that our insightful critique is the product of meticulous research and real-world testing, ensuring you have the necessary data to determine if it's the ultimate accounting tool for your business needs in 2024.

We take pride in our impartial and comprehensive evaluations. Our team, consisting of accounting experts and tech aficionados, has put FreshBooks under the microscope to give you the most trustworthy review:

- Hands-On Experience: Our evaluations stem from direct interaction with the software. Rather than relying on second-hand information, our team has logged countless hours utilizing every feature of FreshBooks.

- Latest Industry Standards: We ensure our analysis of FreshBooks aligns with the most current industry benchmarks for accounting software, giving you a review that is both relevant and forward-thinking.

- Comparison with Competitors: To deliver a balanced perspective, FreshBooks has been compared against other leading accounting tools in various categories such as usability, features, and value for money.

In the sphere of accounting software reviews, credibility is the cornerstone. Rest assured, our approach to analyzing FreshBooks is rooted in a commitment to delivering insights that are not only informative but also actionable, helping you make a decision that could greatly streamline your accounting processes in 2024.

Is Freshbooks Legit? A Look At Freshbooks Reviews

Exploring the legitimacy of FreshBooks, extensive reviews suggest it stands out as a top accounting tool for 2024. Diving into FreshBooks reviews reveals insightful perspectives on its efficiency and user-friendliness for financial management.

Navigating the oceans of accounting software can be quite the undertaking for freelancers and small business owners. Among the plethora of tools available, FreshBooks has emerged as a beacon for many. But the question on everyone's lips is: Can we trust the glowing reviews?

Let's dive into what users are saying about FreshBooks.

Freshbooks Reviews From Users And Experts

When scouring the internet for FreshBooks critiques, it's not just the quantity of reviews that matter—it's their quality. As FreshBooks garners attention worldwide, let's sift through what's being shared:

- User testimonials: FreshBooks consistently receives high ratings from users who appreciate its ease of use and customer support. These accounts underscore how it simplifies invoicing, expense tracking, and time management.

- Expert analysis: Industry mavens commend FreshBooks for its robust feature set and user-friendly interface, noting that it frequently outshines competitors in head-to-head comparisons.

- Awards and accolades: Recognized by reputable tech circles, FreshBooks has accrued a trove of awards, lending credibility to its reputation as a top-tier accounting solution.

Is Freshbooks Reliable For Business Accounting?

Deeming a tool reliable involves a critical look at its performance and service consistency. A scrutinizing eye reveals:

Reliability stands as a cornerstone of the FreshBooks experience, with countless business owners relying on its consistent service delivery. Punctuality and accuracy in financial dealings are non-negotiable, and FreshBooks upholds these standards with:

- Uptime assurance: Users note very few instances of downtime, ensuring access to financial data when needed.

- Data accuracy: With compliance-focused features, FreshBooks demonstrates a staunch commitment to data precision and regulatory adherence.

With these insights, it's apparent that FreshBooks is not just legit; it's a trusted ally in navigating the financial waters of the modern business landscape.

|

| Credit: neilpatel.com |

Frequently Asked Questions For Freshbooks Review: Is It The Best Accounting Tool To Use In 2024?

What Is The Disadvantage Of Freshbooks?

FreshBooks may lack advanced features required by larger businesses and can become costly as you add more clients due to its pricing structure.

What Is The Main Benefit You Receive From Freshbooks Currently?

The main benefit of using FreshBooks is streamlined invoicing and efficient financial management for small businesses and freelancers.

Can Freshbooks Replace Quickbooks?

FreshBooks can replace QuickBooks for small business owners seeking simple, intuitive accounting software with an emphasis on invoicing and time tracking. It may not match QuickBooks for extensive features like inventory management.

What Is The Most Widely Used Accounting Software?

QuickBooks is the most popular accounting software, favored by a majority of small and medium-sized businesses worldwide. Its user-friendly interface and comprehensive features make it the go-to choice for financial management.

Does Freshbooks Offer Multi-currency Support?

Yes, Freshbooks supports multi-currency transactions, allowing for seamless international business operations.

Is Freshbooks Compatible With Mobile Devices?

Freshbooks has mobile apps for both iOS and Android, enabling on-the-go accounting.

Can Freshbooks Integrate With Third-party Apps?

Freshbooks offers integrations with numerous third-party apps to streamline your workflows.

What Security Features Does Freshbooks Have?

Freshbooks employs robust security measures including encryption and secure data centers.

How User-friendly Is Freshbooks For Beginners?

Freshbooks is designed with a user-friendly interface that simplifies accounting for beginners.

Conclusion

In summing up our Freshbooks review for 2024, remember - simplicity and efficiency remain key. Whether managing invoices, tracking expenses, or handling timesheets, Freshbooks stands out with its intuitive interface. For SMEs seeking streamlined accounting software, it's a top choice.

Give it a try for financial management that feels effortless.

Post a Comment